You can download the solution to the following question for free. For further assistance in accounting assignments please check our offerings in Accounting assignment solutions. Our subject-matter-experts provide online assignment help to Accounting students from across the world and deliver plagiarism free solution with free Turnitin report with every solution.

(ExpertAssignmentHelp do not recommend anyone to use this sample as their own work.)

Question

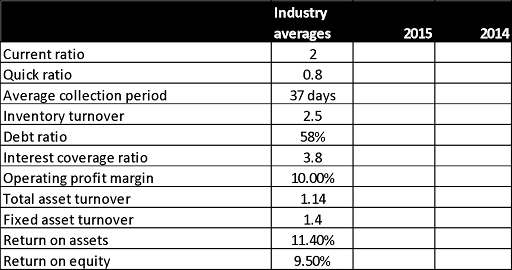

a. Calculate the following financial ratios for 2015 and 2014

b. Evaluate the firm's financial position at the end of 2014 in terms of its liquidity, capital structure, asset management efficiency and profitability.

c. At the end of 2015, the firm has 5000 ordinary shares outstanding, selling for $15 each. What were the firm's (i) earnings per share, (ii) price–earnings ratio, and (iii) market-to-book ratio?

d. Describe your observations about the financial condition and performance of Gelato Industries from your answers to (a) (b) and (c).

- According to Warren Buffet, 'Accounting is the language of business, and you have to learn it like a language… To be successful at business, you have to understand the underlying financial values of the business.' Warren Buffet, is one of the richest men in the world.

- Research and summarise some interesting facts about Warren Buffet

- There are several YouTube featuring interviews and/or commentary by Warren Buffet about how to invest wisely. Below are 3 to get you started. Skip the ads, watch them and summarise the key points that he makes in relation to investment.

Solution

Executive Summary

Investment requires careful examination of the data of a company to evaluate its true worth. The general evaluation method adopted by investors is ratio analysis, based on data available in the financial statement. The report has discussed the attractiveness of the financial performance of Gelato Industries from an investment perspective. The company’s financial performance has been evaluated through financial ratios calculated from the data provided.

Gelato Industries financial data has been provided for the years 2014 and 2015 to analyse the financial health of the company from an investment perspective. The report has mainly focused on financial tool – ratio analysis and its utilisation of it, in the context of Gelato Industries, for making an investment decision. The report has also discussed the investment rules of Warren Buffet in the context of investment decisions made by investors.

Ratio analysis of the company states that the company’s current ratio has decreased from the year 2014 to 2015, which raise a concern for the company as a stiff liquidity position which will send a message to present and prospective investors that the company is inefficient to pay its liabilities. The company’s quick ratio has also declined over the one year, which makes the company’s cash and cash equivalent position stiff. From the investment perspective, an investor will not get attracted by the declining liquidity position of the firm. On further analysis, it has been found that the company has a high inventory turnover ratio, which indicates the company is selling its product at high speed, and low average collection period. A low collection period indicates the company is frequently clearing its account receivable. But the company’s cash position has declined from the year 2014 to 2015, which indicates the company is either investing in working capital more frequently or increasing its reserve amount (retained earnings) instead of maintaining cash balance. The above assertion is proved from the fact that the company is generating high profit, as for the year 2014 profit generated by Gelato industries is $8,597/- while for the year 2015 it is $22,884/- which is almost three folds. The company’s retained earning has also increased over the year from 2014 to 2015 . The company’s increase in return of equity to 30% can be justified with this analysis. The company’s working capital has decreased to a negative value for the year 2015, which indicates the company is not investing its cash or cash equivalent in acquiring more current assets.

The company’s profitability ratio indicates a profitable venture to invest in the Gelato industry. Its ROA is in accordance with the industrial average, and the company is generating sound profit from its assets. The company’s return on equity has increased drastically in the year 2015 to 30%, which is a matter to notice. Though it sends a positive vibe between investors but the company need to analyse whether this growth is temporary or long term.

Lastly, to be concluded, with a high return on equity, it is profitable to purchase a share of the company as compared to debentures. The company is using around 60% debt to fund its ventures; its return is also diminishing, but equity return is increasing over time.

For complete solution please download from the link below

(Some parts of the solution has been blurred due to privacy protection policy)

Check all our academic help services